All Categories

Featured

Table of Contents

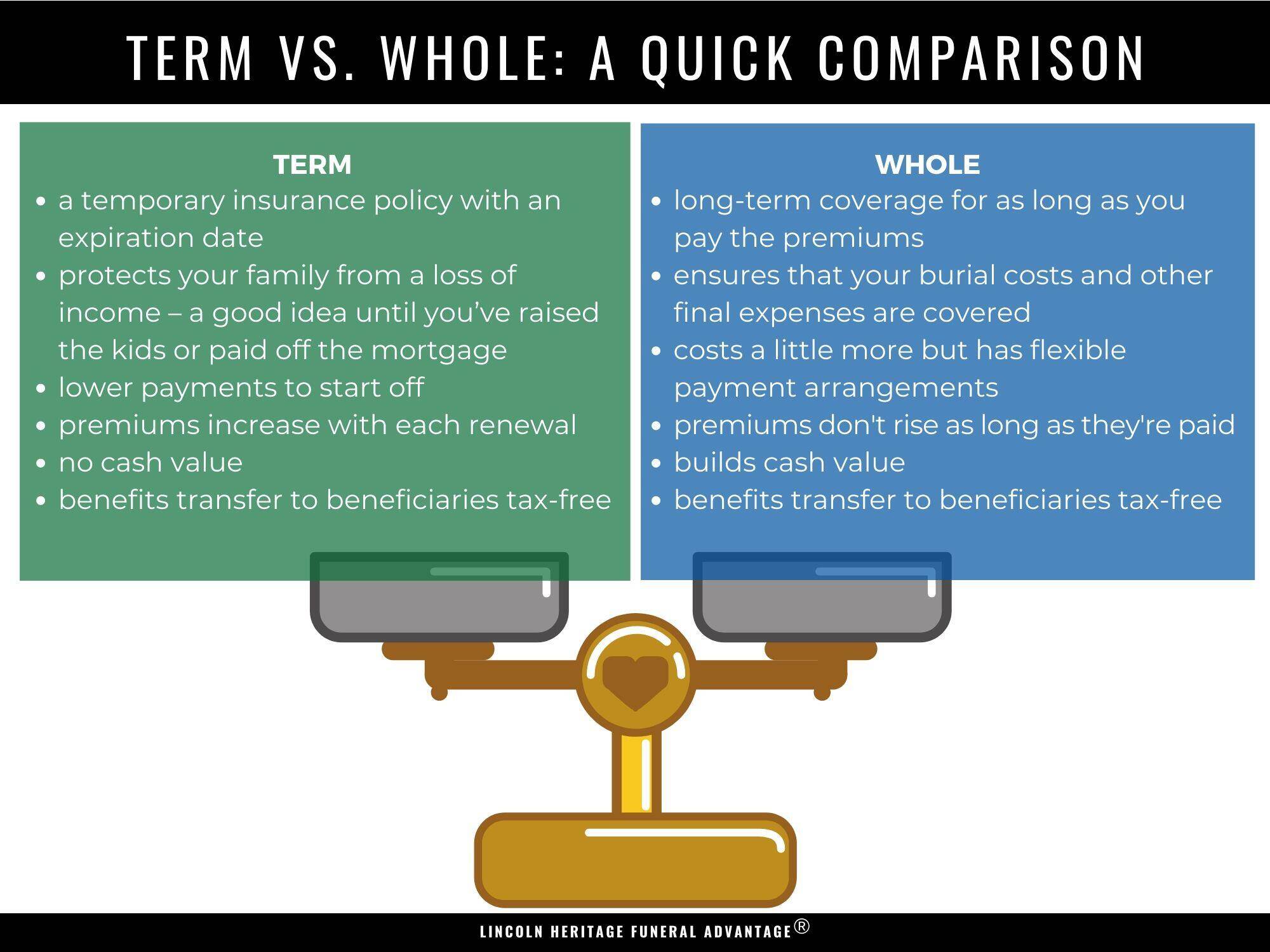

There is no payout if the plan ends prior to your fatality or you live beyond the policy term. You might have the ability to restore a term policy at expiration, but the premiums will be recalculated based upon your age at the time of renewal. Term life insurance policy is normally the the very least pricey life insurance policy offered because it offers a fatality benefit for a limited time and does not have a money value element like long-term insurance policy.

At age 50, the costs would rise to $67 a month. Term Life Insurance Rates 30 years old $18 $15 40 years old $28 $23 50 years old $67 $51 Resource: Quotacy. Quotes are for a $250,000 30-year term life plan, for guys and females in exceptional health and wellness.

Increasing Term Life Insurance Definition

Rate of interest rates, the financials of the insurance coverage firm, and state guidelines can also influence costs. When you consider the quantity of protection you can get for your premium dollars, term life insurance coverage tends to be the least pricey life insurance coverage.

Thirty-year-old George wishes to secure his family members in the not likely occasion of his early fatality. He acquires a 10-year, $500,000 term life insurance policy plan with a costs of $50 each month. If George passes away within the 10-year term, the plan will pay George's recipient $500,000. If he dies after the plan has run out, his recipient will certainly receive no benefit.

If George is detected with a terminal ailment throughout the initial policy term, he possibly will not be qualified to renew the plan when it expires. Some policies offer assured re-insurability (without evidence of insurability), yet such functions come with a greater expense. There are numerous kinds of term life insurance coverage.

A lot of term life insurance coverage has a degree premium, and it's the kind we've been referring to in most of this short article.

After The Extended Term Life Nonforfeiture Option Is Chosen The Available Insurance Will Be

Term life insurance is attractive to youths with children. Parents can acquire substantial protection for an inexpensive, and if the insured dies while the plan holds, the family can count on the death benefit to replace lost earnings. These plans are likewise appropriate for individuals with growing family members.

Term life plans are excellent for individuals who want significant protection at a low expense. Individuals that have whole life insurance pay a lot more in costs for less coverage but have the security of understanding they are secured for life.

The conversion rider must permit you to convert to any irreversible plan the insurance provider provides without restrictions - a long term care rider in a life insurance policy pays a daily benefit in the event of which. The primary features of the biker are maintaining the original health score of the term plan upon conversion (also if you later on have wellness problems or become uninsurable) and determining when and just how much of the coverage to convert

Naturally, general costs will increase dramatically since whole life insurance policy is extra costly than term life insurance coverage. The advantage is the assured approval without a medical test. Clinical conditions that establish throughout the term life period can not cause costs to be boosted. The firm may need minimal or complete underwriting if you desire to add extra riders to the brand-new plan, such as a long-lasting care biker.

Term life insurance is a relatively affordable way to offer a round figure to your dependents if something happens to you. It can be a good option if you are young and healthy and sustain a family. Whole life insurance features significantly higher month-to-month costs. It is indicated to supply coverage for as lengthy as you live.

What Is A Term Life Insurance Rider

It relies on their age. Insurance business set an optimum age restriction for term life insurance coverage policies. This is normally 80 to 90 years of ages but may be higher or lower depending on the company. The costs additionally climbs with age, so an individual aged 60 or 70 will pay significantly even more than a person years younger.

Term life is rather similar to auto insurance. It's statistically unlikely that you'll need it, and the costs are money away if you don't. However if the worst occurs, your family members will obtain the benefits.

This plan layout is for the customer who requires life insurance however want to have the ability to choose exactly how their money value is spent. Variable plans are underwritten by National Life and dispersed by Equity Services, Inc., Registered Broker/Dealer Associate of National Life Insurance Firm, One National Life Drive, Montpelier, Vermont 05604.

For J.D. Power 2024 honor details, check out Irreversible life insurance policy creates cash worth that can be obtained. Plan car loans build up interest and unpaid policy car loans and rate of interest will certainly minimize the survivor benefit and cash value of the plan. The quantity of money value readily available will normally rely on the kind of long-term plan acquired, the quantity of insurance coverage acquired, the length of time the plan has been in pressure and any type of superior policy finances.

20 Year Term Life Insurance Meaning

Disclosures This is a general summary of protection. A full declaration of coverage is found just in the policy. For more details on insurance coverage, prices, constraints, and renewability, or to look for coverage, contact your regional State Ranch representative. Insurance coverage and/or linked bikers and functions may not be available in all states, and plan terms and problems might vary by state.

The primary distinctions between the different kinds of term life plans on the market involve the size of the term and the insurance coverage quantity they offer.Level term life insurance comes with both level premiums and a level death advantage, which indicates they stay the exact same throughout the duration of the plan.

, additionally known as an incremental term life insurance coverage plan, is a policy that comes with a fatality benefit that boosts over time. Usual life insurance coverage term lengths Term life insurance is economical.

The major distinctions between term life and entire life are: The size of your protection: Term life lasts for a set period of time and then ends. Average monthly entire life insurance rate is determined for non-smokers in a Preferred health and wellness classification, obtaining an entire life insurance coverage plan paid up at age 100 provided by Policygenius from MassMutual. Aflac supplies numerous long-lasting life insurance policies, including entire life insurance, last cost insurance coverage, and term life insurance.

Latest Posts

Funeral Scheme Underwriters

End Of Life Insurance Policies

North Carolina Term Life Insurance